41+ can i deduct mortgage insurance premiums

However the insurance contract must have been. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI.

Kemptville072513 By Metroland East Kemptville Advance Issuu

Be aware of the phaseout limits however.

. You can use this method to figure the current year. Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP. Web Eligible W-2 employees need to itemize to deduct work expenses.

SOLVED by TurboTax 5841 Updated January 13 2023. Web You can only claim a mortgage insurance premium tax deduction if you are filing for tax year 2021 or earlier. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you.

The itemized deduction for mortgage. Web Yes through tax year 2020 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. However higher limitations 1 million 500000 if married.

The PMI tax deduction works for home purchases and for refinances. Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically. Whether you qualify depends on both your filing status and.

Web You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage. You can use Publication 936 to help calculate. If you opt for the.

Web The tax deduction for PMI premiums or Mortgage Insurance Premiums MIP for FHA-backed loans is not part of the tax code but since the financial crisis has. How do you know if your PMI qualifies for. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Web Can I deduct private mortgage insurance PMI or MIP. Web If you have an FHA loan you may be able to deduct your mortgage insurance premium if your loan originated after December 31 2017 and your annual.

Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses. If you are claiming itemized deductions you can claim the PMI. Web To determine if your mortgage insurance premiums entitle you to a tax deduction you need to know if you are taking the standard deduction or itemizing.

Web The deduction applies to premiums on mortgage insurance provided by the Department of Veterans Affairs the Federal Housing Administration the Rural Housing Service and.

How To Get Cheaper Homeowner S Insurance 9 Must Try Strategies

Mortgage Insurance Is Tax Deductible By Mgic Mortgage Professional

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Can I Deduct Mortgage Insurance Premiums From Rental Property Sapling

Is There A Mortgage Insurance Premium Tax Deduction

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Is Mortgage Insurance Tax Deductible Bankrate

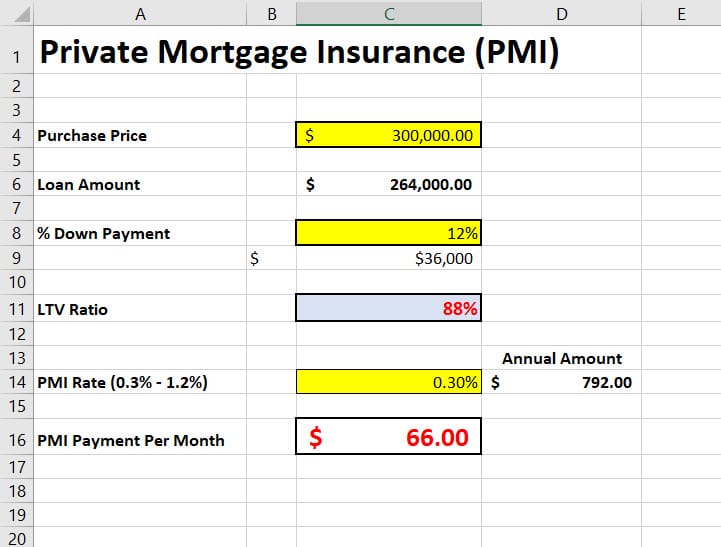

How To Calculate Private Mortgage Insurance Pmi Excelbuddy Com

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

Solved Ii Life Insurance Premium A Life Insurance Policy Chegg Com

Business Succession Planning And Exit Strategies For The Closely Held

Is Mortgage Insurance Tax Deductible Bankrate

Can I Deduct Mortgage Insurance Premiums From Rental Property Sapling

Mortgage Insurance Premiums Are Still Deductible For The 2017 Tax Year Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is Mortgage Insurance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Private Mortgage Insurance How Pmi Works Cnet Money